How to Effectively Establish Standard Operating Procedures and Workflows for the Finance Department

![]() GateMaster.ai

/

October 27, 2024

GateMaster.ai

/

October 27, 2024

In today’s fast-paced business environment, the finance department plays a critical role in ensuring the financial health and compliance of an organization. To achieve operational excellence and maintain consistency, it is essential for finance teams to establish clear and effective Standard Operating Procedures (SOPs) and workflows. These documents serve as vital blueprints that guide employees in their daily tasks, enhance productivity, and minimize the risk of errors. By systematically documenting processes, finance departments can ensure that all team members are aligned and equipped to handle their responsibilities efficiently. This article outlines a structured approach to creating SOPs and workflows that not only streamline operations but also support the overall strategic goals of the organization. Whether you are starting from scratch or looking to refine existing procedures, the following steps will provide a comprehensive framework for developing effective SOPs that empower your finance team.

Creating Standard Operating Procedures (SOPs) and workflows for a finance department involves several key steps to ensure that all processes are documented clearly and efficiently. Here's a structured approach to help you generate these documents:

Step 1: Identify the Processes

- List Key Functions: Identify the core functions of the finance department such as accounts payable, accounts receivable, payroll, budgeting, financial reporting, and audits.

- Prioritize Processes: Determine which processes are most critical or in need of documentation first.

Step 2: Gather Information

- Consult Stakeholders: Engage with finance team members, managers, and other departments to understand existing processes.

- Review Existing Documentation: Collect any existing documents, manuals, or guidelines that pertain to current processes.

Step 3: Define Objectives

- Purpose of SOPs: Clearly define the purpose and scope of each SOP. This will guide the content and ensure relevance.

- Compliance and Standards: Ensure alignment with regulatory requirements and industry standards.

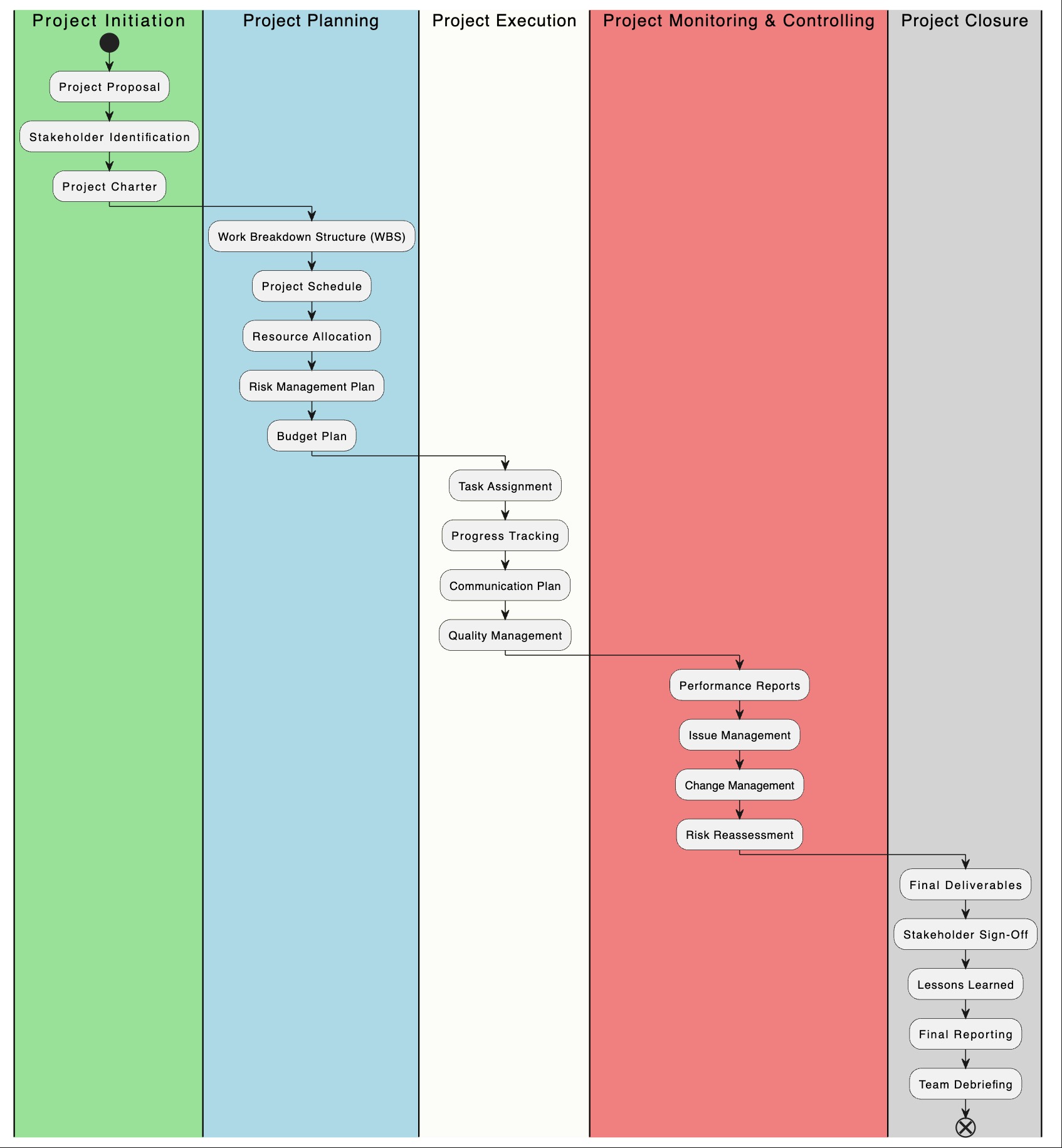

Step 4: Document the Processes

- Process Mapping: Use flowcharts or diagrams to map out each process step-by-step. Include inputs, outputs, and decision points.

- Detailed Steps: Write detailed instructions for each step in the process, including responsible parties, timelines, and required documentation.

- Use Clear Language: Ensure the language is clear, concise, and free of jargon to make the SOPs accessible to all users.

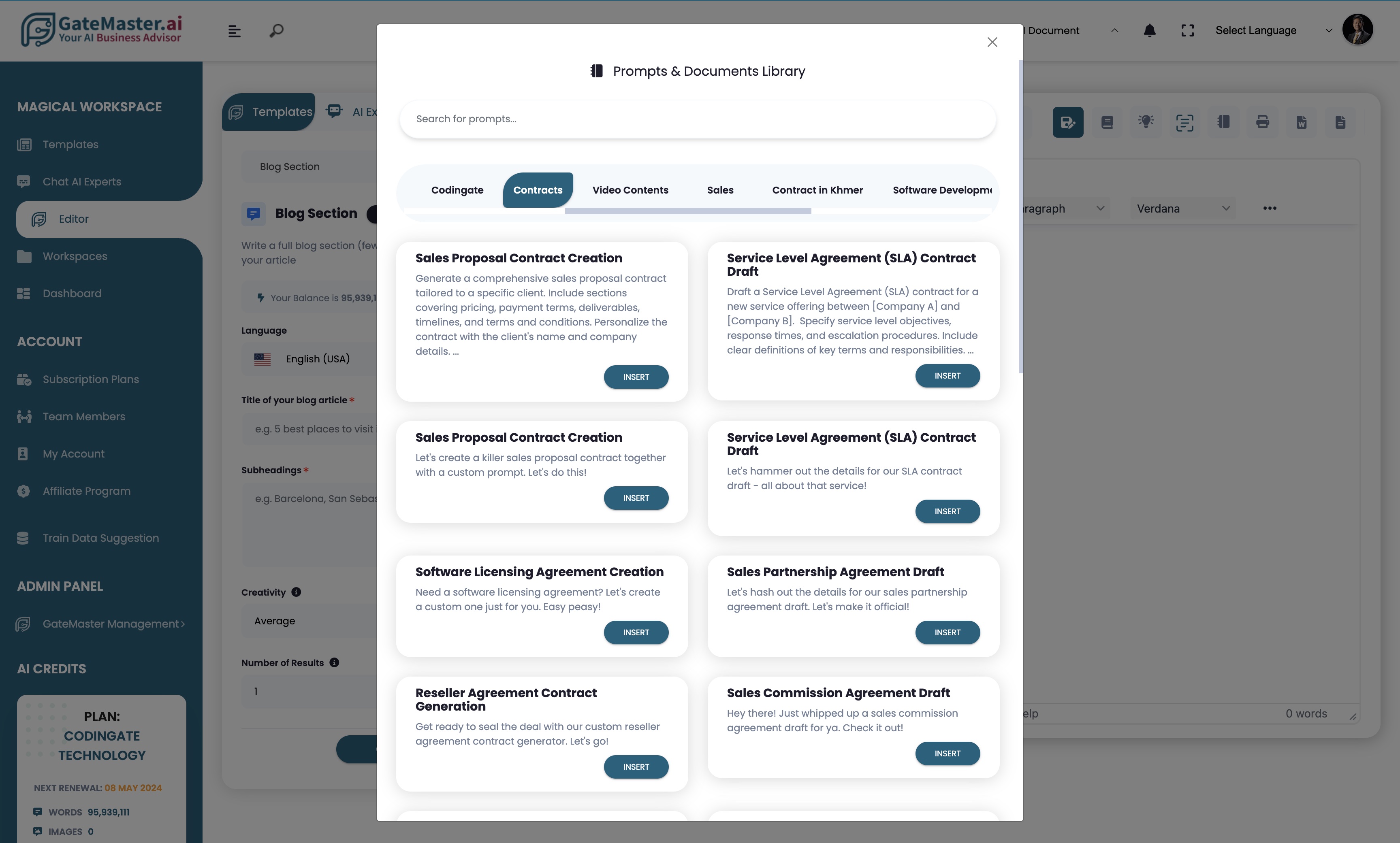

- You can generate detailed Standard Operating Procedures (SOPs) and workflows for each stage of the finance department's processes, step by step, using the AI prompt provided below:

" Generate all possible SOPs and workflows for the finance department for [Business Type] in table format

Detailed Steps: write detailed instructions for each step in the process, including responsible parties, the conditions inputs, outputs, decision points, timelines, and required documentation for a complete operational cycle of Finance Department

Use Clear Language: Ensure the language is clear, concise, and free of jargon to make the SOPs accessible to all users "

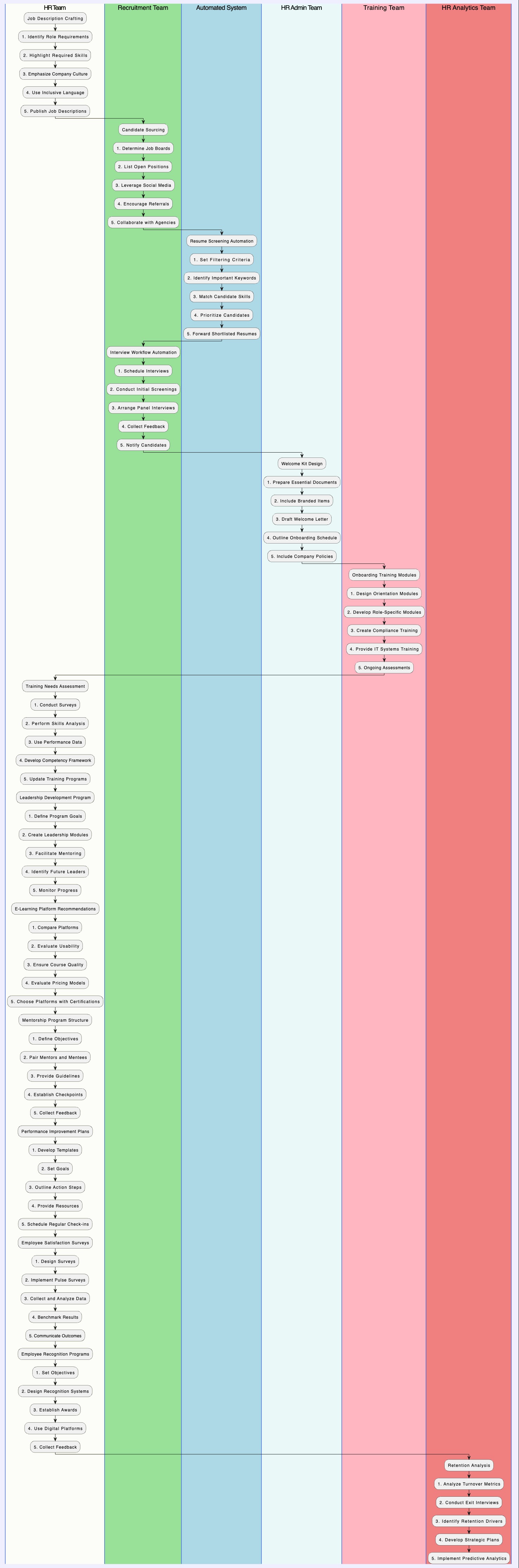

Step 5: Develop Workflows

- Visual Representation: Create visual workflows for complex processes to provide a quick reference guide.

- Software Tools: Consider using GateMaster.ai GateDraw - Flowchart and Diagram Design Tool to create and manage workflows.

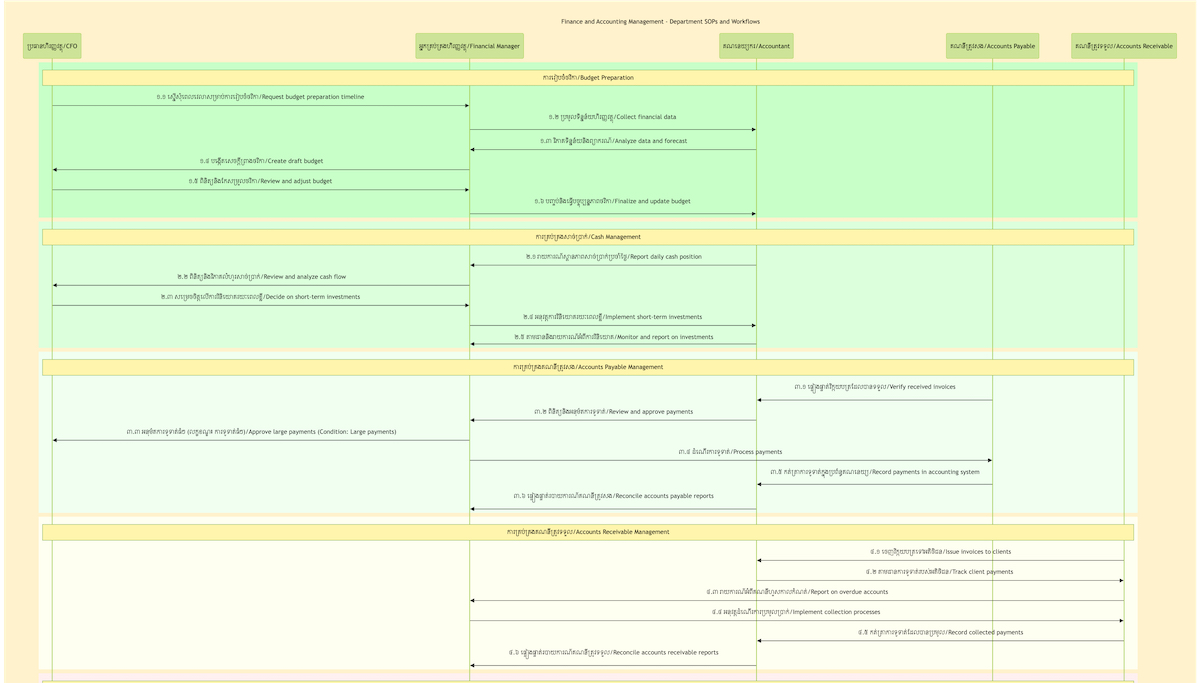

- You can generate sequence diagram of Standard Operating Procedures (SOPs) and workflows for each stage of the finance department's processes, step by step, using the AI prompt provided below:

"Generate a [Sequence Diagram] in both Khmer and English using Mermaid code for the Standard Operating Procedures (SOP) of the [Department Name].

The diagram should encompass a complete operational cycle based on the SOPs and Workflows of Finance Department was generated above. Utilize the 'forest' theme for the diagram. Identify relevant roles and activities within each section (rect/division) by following the provided steps, and assign identifiers to each phase and activity along with the timeline. Ensure that each section has a distinct background color (color palette) for easy viewing. Instead of using spaces for separation, we will use the / symbol to separate Khmer and English words. "

Below is the example of Sequence Diagram of Finance Department generated from GateDraw

Step 6: Review and Revise

- Internal Review: Have the draft SOPs reviewed by team members who are directly involved in the processes.

- Feedback Loop: Incorporate feedback and make necessary revisions to ensure accuracy and completeness.

Step 7: Approvals and Compliance

- Management Approval: Obtain approval from finance department leaders and, if necessary, compliance officers or legal advisors.

- Version Control: Implement a system for version control to keep track of revisions and updates.

Step 8: Training and Implementation

- Training Sessions: Conduct training sessions for the finance team to familiarize them with the new SOPs and workflows.

- Integration into Daily Operations: Ensure the SOPs are integrated into daily operations and used as a reference for decision-making.

Step 9: Monitor and Update

- Regular Reviews: Schedule regular reviews to ensure the SOPs remain current and relevant as processes and regulations change.

- Continuous Improvement: Encourage feedback to identify areas for improvement and make updates as needed.

By following these steps, you can create comprehensive and user-friendly SOPs and workflows that enhance the efficiency and effectiveness of your finance department.

Stay up to Date

Phearin Master Trainer

Phearin Master Trainer

GateMaster.ai

GateMaster.ai

GateMaster.ai Admin

GateMaster.ai Admin